SILEX RISK MANAGED

HORIZON 2028

Sub-fund management delegated to SILEX Investment Managers (SUISSE) SA.

A dated fund with SILEX is the easiest way to express these convictions for attractive returns while keeping default and duration risks low.

Launched on the 14th of September 2022

*S&P rating or a rating deemed equivalent by the Investment Manager

DISCOVER HORIZON 2028

Fund description_

SILEX RISK MANAGED HORIZON 2028 is a sub-fund of corporate and sovereign bonds from EU and/or OECD countries with a maturity date of 31 December 2028.

Key advantages_

Dated funds are the simplest and most transparent structures that keep risks low, hold a diversified portfolio while benefiting from a great cyclical entry point. They offer diminishing interest rate sensitivity and credit risk over time, and a potential return determined at inception.

Investment objective_

SILEX RISK MANAGED – Horizon 2028 is an active discretionary fund with a fixed maturity (31/12/2028) composed of bonds issued by private or public issuers from EU and/or OECD countries, which aims at capital appreciation at maturity (31/12/2028), and which differs according to the share class subscribed as specified in the prospectus **.

** Please refer to the sub-fund’s prospectus for more information on the investment objective. It does not guarantee a return or performance of the sub-fund, performance is not guaranteed. The composition of the portfolio may change.

Want to have more info about the strategy?

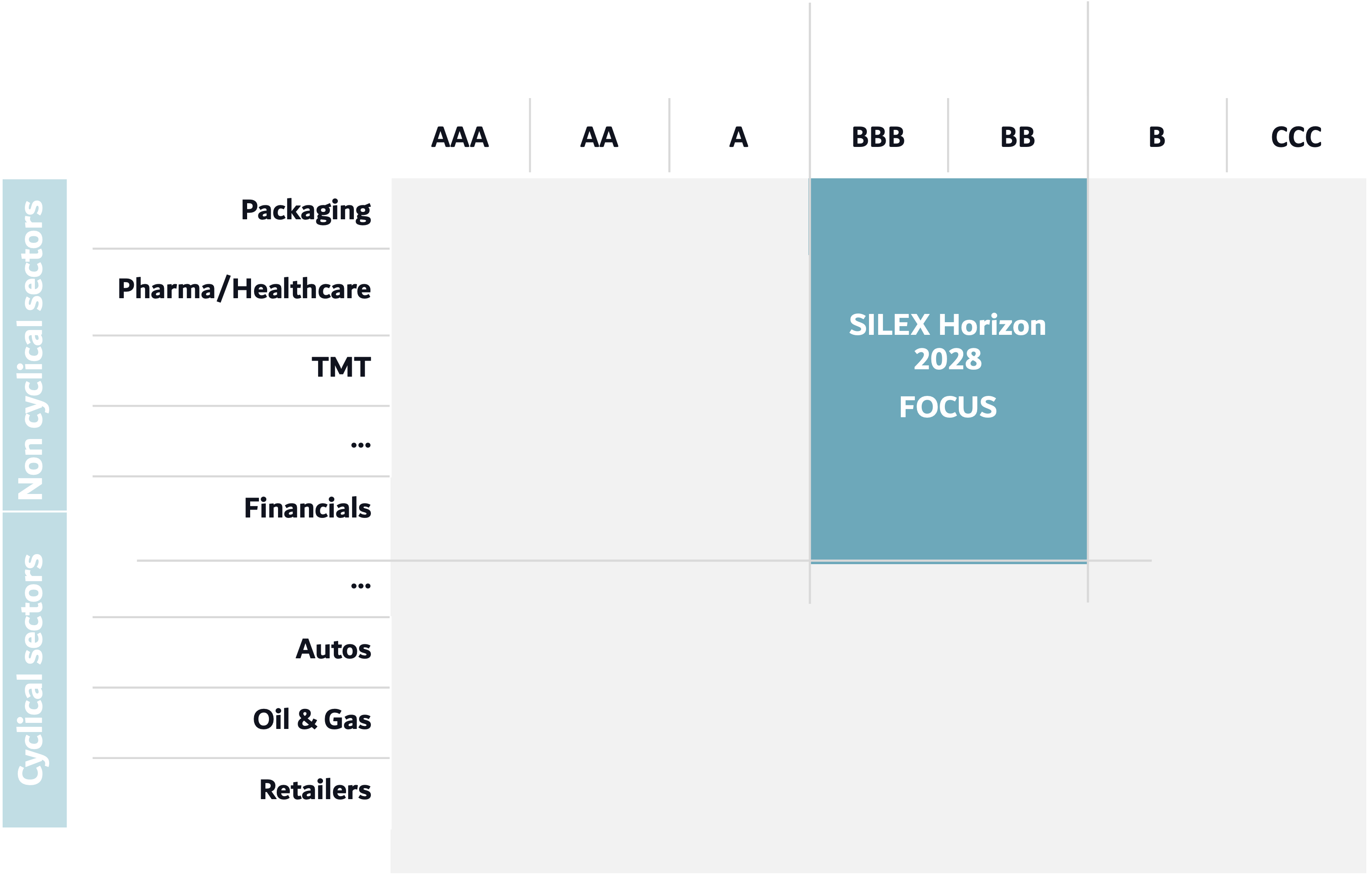

markets non-cyclical

BBB, BB bonds*

management team

4.8% EUR weighted

average yield ***

SILEX has an obligation of means, not of result. Future results may differ from the expected results.

***Sources: Bloomberg, SILEX. Data as of 06/02/2023

. risks

Capital risk, Credit risk, Foreign exchange risk, Discretionary Management risk, Liquidity risk, Interest rate risk, Sustainability risk

- Currently one of the best risk adjusted reward in the fixed income segment

- Very low default rates

- A large investment universe

- Rewarding all-in yield

- Attractive entry point relatively to historical valuations

- Strong upcoming catalyst for bonds

- Simple and transparent

- Decreasing risk over time

- Diversified portfolio

- Highly skilled and experienced team

- Established fixed income franchise

- Product design

A unique opportunity in the current environment_

Very compelling cyclical entry point

Investment process and portfolio_

Investment team_

Philippe Kellerhals, CFA

Head of Fixed Income

Gérald Sinnasse

Horizon 2028 Portfolio manager

Cyril Parison

Head of Credit research and advisory

Eric Bozzetto

Convertible bonds Portfolio Manager

An experienced and versatile Fixed Income team: 4 members, average experience of 23 years

Extensive in-house resources:

– An investment committee covering all traditional asset classes

– A strong Macro & Allocation expertise

Information regarding the background and experience of SILEX employees is provided for information purposes only and is accurate as of 17/02/2023.

Characteristics_

(1) Relative to €STR+8.5bps capitalized + 1% pa (in EUR).

(2) Relative to SARON capitalized + 1% pa (in CHF).

(3) Relative to SOFR capitalized + 1% pa (in USD).

(4) Relative to SONIA capitalized + 1% pa (in GBP).

(5) Professional investors only.

Risks_

SFDR: Article 6, the sub-fund do not take the sustainability criteria into account .

Discretionary management risk: Anticipations of financial market changes made by the Investment Manager have a direct effect on the Fund’s performance, which depends on the stocks selected. Capital risk: The strategy does not provide its investors with any guarantee against the loss of capital. Accordingly, investors bear the risk of the loss of some or all of their investments. Credit risk: The Fund’s performance may be affected by adverse changes in the ability or willingness of bond issuers to repay the capital or interest due. Interest rate risk: The Fund’s performance may be affected by changes in interest rate curves. Liquidity risk: In difficult market conditions, certain Fund investments may be harder to sell at the last quoted market price. Foreign exchange risk: Fluctuations between the currency of denomination of the bond holdings and the base currency of the Fund may negatively affect the Fund’s performance. Sustainability risk: An environmental, social or governance event or situation that, if it occurs, could have a material adverse effect on the value of an investment.

Promotional document produced on 5 September 2022.

This document is not for distribution to retail investors or US investors, but is for the exclusive use of institutional investors acting on their own account and categorised either as “eligible counterparties” or “professional clients“ within the meaning of markets in financial instruments directive 2014/65/EU, and for qualified investors for Switzerland. This document may not be reproduced in whole or in part without prior authorization from SILEX INVESTMENT MANAGERS. It has not been reviewed or approved by any regulator in any jurisdiction. It does not constitute an offer to subscribe or an investment advice. SILEX IM shall not be held responsible for any investment or disinvestment decision taken on the basis of the information contained in this document. The UCI is exclusively intended to be marketed to professional investors in the countries of registration and is not authorized to be marketed in any other jurisdiction or to retail investors. This document is not intended for citizens or residents of the United States of America or «U.S. Persons» as defined in Regulation S of the Securities Act of 1933. Any investment involves specific risks. Investors are advised to ensure that any investment is suitable for their personal situation by seeking independent advice where necessary. SILEX IM assumes that all investors understand the risks inherent to the activities described in this document. The information contained in this document may be partial and is subject to change without notice. The risks and fees are described in the DICI and prospectus, which are available free of charge in English on the website www.silex-im.com, and/or upon written request to SILEX IM. Regulatory information is available free of charge, in English and/or French, also on the website and/or upon written request to SILEX IM. The DICI and prospectus must be given to the subscriber prior to subscription. The tax treatment depends on the individual situation of each investor and may be modified at a later date. The information contained in this document is not intended to replace the information in the DICI and prospectus. Investors should read it before making any decision. Past performance is no guarantee of future results. SILEX IM provides non-independent advice. The complaint procedure is available free of charge on the website of SILEX IM. All rights reserved. This document is not for distribution to retail investors or US investors but is for the exclusive use of institutional investors acting on their own account and categorised either as “eligible counterparties” or “professional clients“ within the meaning of markets in financial instruments directive 2014/65/EU, or qualified investors within the meaning of LSFin regulation. Confidential to recipient, not for reproduction. Promotional article. This document and any information enclosed within it may contain restricted, privileged and confidential information and are therefore intended for distribution to authorised persons only. If you are not the intended recipient of this document, you must not disseminate, modify, copy/plagiarise or take action in reliance upon it, unless permitted by SILEX. With respect to the present document, neither SILEX nor any of its employees or representatives, makes any warranty or representation, whether express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of any information disclosed. Neither SILEX nor any of its employees or representatives assumes or accepts any liability and/or responsibility whatsoever caused by any action taken in reliance upon this document. This content is not intended to be a solicitation nor an offer of service, it solely has the purpose of informing professional investors. The preparation of the information provided herein is done with a high level of care. Nevertheless, errors are possible. The recipient of this document is urged to seek the advice of professionals in order to discuss the risks involved with the businesses described in this document. Past performance is not necessarily indicative of future performance. Reference to certain securities and financial instruments is for illustrative purposes only. SILEX assumes that all users understand risks involved in the businesses described in this document. SILEX reserves the right to modify the contents and the terms of this document at all times. All rights reserved.